Wahed Invest is an Islamic Roboadvisor based on US that has been launched in Malaysia. This will be the 3rd Roboadvisor after Stashaway and MyTheo.

Being an Islamic roboadvisor most likely means that it will invest only in Islamic ETFs/funds or financial instruments that is shariah compliant (eg sukuk bonds, gold). The roboadvisor supposedly do not invest in companies like hotels, beer brewery, cigarette companies, conventional banks and military equipment. (Note : They are not suppose to invest in conventional non islamic banks because of the interest part which banks charges)

The company (Wahed Invest) was also recently licensed to operate in Malaysia by Security Commissions Malaysia (http://www.bernama.com/en/news.php?id=1783902)

Signing up was quite straightforward process, just download the mobile app and register. There seems to be a disconnect between the mobile app and the browser version, the mobile app allows Malaysians to register an account but the browser version still lists the Robo advisory services not available in Malaysia.

As usual, the signing up process involves e-Kyc (know your customer) where your identification card picture is required to be uploaded. The e-Kyc is a very long process and you will need the following documents :

- ID card/passport

- proof of address doc (MYKad, driving license, utilities bill, etc)

- my referral code 'cheong1' to get free RM10

- 1-2 working days for verification and funds transfer to complete

Wahed Invest is not limited to muslim investors, non muslim investors also can sign up. It is just that this app will invests in Shariah compliance investment instruments. The investment options that the app can invests is lesser than other investment products out there. However, limited options doesn't necessarily means having lower performance, the other way of looking at it is it can be more focused.

The management fees charge are quite similar to what Stashaway is charging but lower than MyTheo Robo Advisor. The fees are less than 1%.

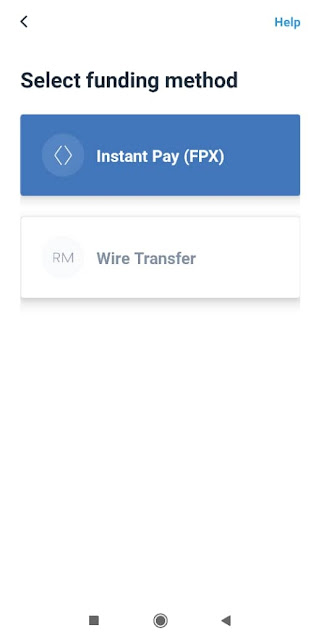

Payments can be done via FPX

Update 20191107 : Finally got my funds in. This Roboadvisor seems to have local flavor as it invests in Malaysia equities. For Stashaway and MyTheo roboadvisors, their ETF selections are all US listed ETFs.

The recommended portfolio generated by Wahed invest based on was "Moderately Aggressive" based on the risk profile questionnaires during sign up.

The app splits the invested money into US stocks, Malaysia stocks, Sukuk (Islamic Bonds), Gold and Cash.

Update 20191108 : The fund made a slight gain of RM3 :) . It's way too early to tell if it's a good Robo advisor but there is definitely a slight psychological boost with this tiny gains.

Update 20191111 - Updates on portfolio, slight dip and more realistic returns for such a short period of monitoring. The dashboard page interface is quite straightforward that it shows an immediate view of the gains and earnings.

Update 20191111

Update 20191125

Thanks to president Donald Trump, US stocks reaching new highs, so money in roboadvisor also rise a bit.

Update 20191216

Seeing some signs of stock market recovery, I just added in a small amount into Wahed Invest. There's now a slight 2.25% increase in my Wahed invest portfolio.

Update 20191218

Update 20191222

I've added in RM200 into total portfolio. Decided to double down as got some spare cash on hand from company bonus. Total amount in my portfolio now is above RM1,000.

Update 20191229

Some meaningful gains here in line with year end funds window dressing activity.

Update 20200109

I was expecting some losses after news of Iran retaliating against US for killing one of their top generals but instead the portfolio still continuing it positive growth.

Update 20200115

Every month Wahed Invest will email a summary of account statement in PDF for easier reference and tracking.

My friend who used my referral code's performance looks ok (average) only as he signed up to the app just the day US and Iran relations went sour. So sometimes, timing of entering sometimes is also important.

Update 20200120

From the apps, I'm still continue riding the gains.

Update 20200122

Ok I got to admit, seeing the portfolio grow is very addictive.

Update 20200125

Portfolio returns finally breached the 6% mark.

I'm not sure what returns others are getting but I'm on the Moderately Aggressive plan.

I did some study on what was powering these gains and found that the gains were coming from US equities (Dow Jones US Titans 50). The Malaysia funds were doing very bad, given that KLCI was the worst performing market in Asia Pacific. The Wahed invest portfolio should have more upside if the KLCI recovers. Also, I have topped up RM100 into the portfolio today.

Compared to the other robo advisors like MyTheo and Stashaway, Wahed Invest seems to be invests in less ETFs which I think could be an edge for now because ETFs are essentially already a diversified fund, making its returns more focused. If a robo advisor invests in multiple ETFs, the overall returns needs to depend on the overall returns of all the ETFs. ETFs are exchange traded funds, they are like mutual funds/unit trusts but can be freely traded on the stock exchange and consists of a basket of stocks.

To be frank, Wahed Invest doesn't really look too sophisticated as it only focuses on 4 investments only namely

- Dow Jones US Titans 50

- MSCI Malaysia Islamic Dividend

- RHB Islamic Bond

- Gold ETF

In theory, individuals can buy the funds themselves but I feel a robo advisor assists to rebalance (buy and sell depending on changing risks) and makes it like an automated savings plans. Nowadays people are just way to busy to deal with investing complexities.

MYETF Dow Jones US Titans 50 fund can be individually bought over Bursa Malaysia with stock quote 0827EA. Behind the fund it consists of 50 large cap companies on Dow Jones. The ETF has been rising since October and therefore that explains the increase in my Wahed Invest portfolio value.

I also noticed Wahed Invest app now added in recurring deposit feature for users to automatically and regularly (weekly and monthly) deposit in money into the portfolio. This feature is good for making force and regular savings into the portfolio automatically from bank account. The simplicity it has also could be an edge as it keeps the investment portfolio not too over diversified given that ETFs are already consists of a basket of stocks.

Wahed Invest app is also now listed as the top 3 software at Apple Appstore Malaysia.

Update 20200130

Topped up another RM500 seeing that there is a downturn in equities worldwide and Malaysia KLCI sinking to new lows due to the Corona virus scare. I expect the portfolio's Malaysia equities to weaken further but I also see it as an opportunity for a reversal when this whole fiasco is over.

Right now we're at uncertain territory with the global virus scare. I do expect portfolio to go down a bit but it should not be too drastic as the app is investing in baskets of investments like ETF which is essentially a collection of stocks pooled together.

Update 2020215

My friend's portfolio updated on 20200115 which had a negative return has turn positive already. From negative RM-1.73 , he has a gain of RM 177.59.

Update 2020217

It has been brought to my attention that there are some screenshots messages going on about someone using Wahed Invest name saying that the company was giving out dividends in extreme excess of 30%, 50% and 100%. I am 100% sure this is a pyramid scheme (aka scam) using the good name of Wahed Invest to entice people to sign up. The best investment managers in the world cannot achieve these figures at all. Warren Buffet, Ray Dalio and Paul Tudor Jones who are the world's best investors/traders also do not get such super extraordinary gains. The whole scheme smells and reeks of a pyramid scheme. As such do please be aware of such fake and preposterous claims.

The 'real' Wahed Invest is not going to give such spectacular gains as the investment instruments it invests in are (ETF, Sukuk, Gold) has never been able to do so. The 'real' Wahed Invest also do not have Silver, Gold and Diamond packages, there is no such thing as high returns with guaranteed returns in investing.

----------------------------------------------------------------------------------------------

You can use my referral/invite code : cheong1 when signing up to Wahed Invest. You and I will get RM10 for each activation after you have topped up a minimum RM100, from there you can do your invites to friends also and make some spare cash. A referral is basically how startup companies get the masses like me who like the service to promote their products to friends. This saves the company a lot of advertisement fees while growing fast by having customers who use and like the products to promote the company.

Do note that I have to declare I'm also registered with the other 2 roboadvisors like Stashaway and MyTheo. I no longer check my Stashaway account as it's generating slow but steady returns and I'm diversifying my savings to other roboadivisors. I'm still new to MyTheo and only put in a small sum into it.

Wahed Invest's management fees compared with Stashaway, MyTheo and normal unit trust funds

Wahed Invest :

0.8% p.a. fees for RM100 – RM499k

0.4% p.a. fees for RM500k and above

Stashway :

0.8% p.a fees for RM 50K

0.7% p.a fees for RM 50K to RM 100K

MyTheo :

1.% p.a fees for RM 30K

0.9% p.a fees for RM 30k to RM 100K

FSMOne Managed Portfolio :

1% p.a fees

1.25% sales fees

Mutual Funds/Unit Trusts :

Typically 1.8% p.a fee for equity funds

on top of 3-6% sales fees

On paper, Wahed Invest's management fees could be less than Stashaways. However, I think Stashaway has a slight advantage if you invest above 50K and your management fees reduces to 0.7%. Wahed invest's 0.4% management fees is a bit out of grasp for ordinary Malaysians as the total amount invested needs to be 500K which is a very very big amount for most people.

Links

Wahed Invest Contact Helpdesk Support Call

+60 16 299 1615

Disclaimer : I just signed up only and put in less than 1k into the account. I will be writing a series of blog on this new financial service as time progresses.

In my opinion, robo advisors are not get rich quick systems. They can compliment your existing investment vehicles (unit trusts, ASB, REITS) and are designed for 'invest and forget' kind of investment style. You should not monitor the portfolio daily as it is designed to be automated, to buy and sell ETFs and balance it based on your investment appetite. I also like to think robo advisors as a virtual coin containers (sometimes dubbed as a piggy bank) where all your spare change are put inside it and it accumulates over time where in this case you transfer all your space change (cash) online to robo advisors. This way of moving spare change is called micro-savings and micro-investing was previously not possible using unit trusts due to minimum initial investment (eg min RM1000) and subsequent investment (eg min RM100).

I did a super quick video showing the interface inside the Wahed Invest app.

You can use my referral/invite code : cheong1 when signing up. You and I will get RM30 (~USD10) for each activation after you have topped up a minimum RM100, from there you can do your invites to friends also.